Starting a business in Nepal? You have probably heard about PAN and VAT registration and might be confused about which one you need. Don’t worry you are not alone! Many entrepreneurs get stuck at this step.

Here is the good news by the end, you will know exactly which registration you need VAT vs PAN Registration Nepal, when you need it and how to get it.

What is PAN Registration?

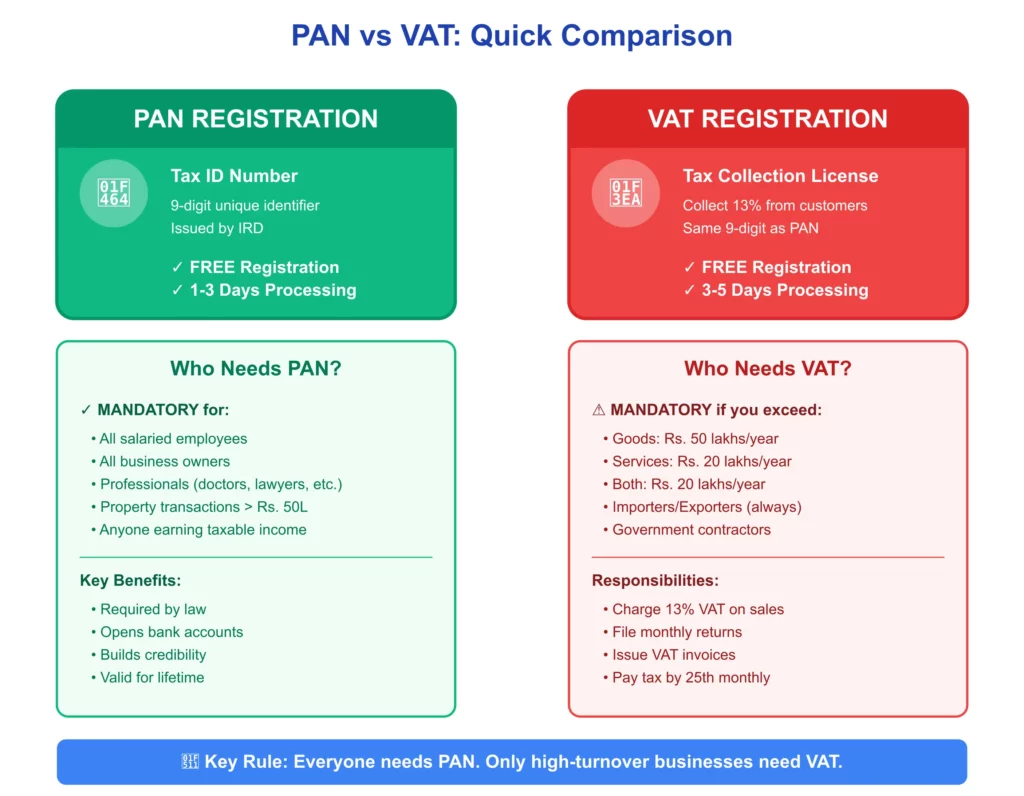

PAN stands for Permanent Account Number. It’s a unique 9 digit number that the government gives you to track your taxes. Think of it as your tax ID card.

Who Needs PAN?

According to Nepal’s Income Tax Act 2058, PAN registration is mandatory for all businesses and individuals engaged in income generating activities.

You MUST get PAN if you:

- Have a job and earn salary

- Own any type of business (shop, restaurant, consultancy, anything)

- Are a professional (doctor, lawyer, engineer, consultant)

- Buy or sell property worth more than Rs. 50 lakhs

- Want to open a business bank account

- Make or receive payments above Rs. 10 lakhs

Simple rule: If you are making money legally in Nepal, you need PAN.

Benefits of PAN Registration

- It’s mandatory by law – You can’t avoid it

- Opens doors – Needed for bank accounts, loans, business registration

- Builds credibility – Shows you’re a legitimate taxpayer

- Completely free – There is no government fee for PAN registration

- Valid for life – Get it once, use it forever

PAN Registration: Quick Facts

| Detail | Information |

| Who issues it? | Inland Revenue Department (IRD) |

| Cost | FREE (Rs. 0) |

| Processing time | 1-3 working days |

| Validity | Lifetime |

| Mandatory for | Everyone with income |

What is VAT Registration?

VAT stands for Value Added Tax. It is a 13% tax that businesses collect from customers when selling goods or services. The business then pays this tax to the government.

Who Needs VAT?

VAT registration becomes mandatory only after a business crosses specific turnover thresholds. Here are the rules:

You MUST register for VAT if:

- For businesses selling GOODS only:

- Your annual sales exceed Rs. 50 lakhs (Rs. 5,000,000)

- Example: If you run a grocery store and sell products worth Rs. 51 lakhs in a year

- For businesses providing SERVICES only:

- Your annual sales exceed Rs. 20 lakhs (Rs. 2,000,000)

- Example: If you are a consultant and earn Rs. 21 lakhs in a year

- For businesses doing BOTH goods and services:

- Your annual sales exceed Rs. 20 lakhs (Rs. 2,000,000)

- Example: If you run a restaurant (food = goods, service = services)

- Special cases (regardless of turnover):

- Importers bringing goods worth more than Rs. 10,000

- Businesses exporting goods

- Government contractors

What If Your Sales Are Below the Threshold?

If your sales are less than these amounts, you DON’T need VAT registration. It is optional.

However, some businesses voluntarily register for VAT even when not required because it helps them:

- Claim input tax credits on purchases

- Look more professional

- Work with big companies (who prefer VAT-registered suppliers)

VAT Registration: Quick Facts

| Detail | Information |

| Who issues it? | Inland Revenue Department (IRD) |

| Cost | FREE (Rs. 0) |

| Processing time | 3-5 working days |

| Validity | Until you deregister |

| Tax rate | 13% on sales |

| Filing frequency | Monthly (by 25th of next month) |

The Big Difference: VAT vs PAN Registration Nepal

How to Register for PAN

The process is simple and can be done online:

Step 1: Visit IRD Website (Go to www.ird.gov.np )

Step 2: Fill Online Form

- Click on “Taxpayer Portal”

- Select “Registration (PAN, VAT, EXCISE)”

- Choose “Personal PAN” (for individuals) or “Business PAN” (for companies)

- Fill in all details carefully

Step 3: Upload Documents

- Citizenship certificate (or passport for foreigners)

- Recent passport-size photo

- Business registration certificate (for businesses)

- Bank account details

Step 4: Submit and Print

- Submit the online form

- Print the application form

- Note down your submission number

Step 5: Visit IRD Office

- Take printed form and original documents

- Go to your nearest IRD office

- They’ll verify your identity

- You’ll get your PAN within 1-3 working days

Total cost: FREE

Total time: 1-3 working days

For detailed instructions, visit: IRD’s official website

How to Register for VAT

Once you have PAN, here’s how to get VAT:

Step 1: Check If You Need It

- Calculate your annual turnover

- See if you cross the threshold (Rs. 50 lakhs for goods, Rs. 20 lakhs for services)

Step 2: Apply Online

- Visit www.ird.gov.np

- Log into Taxpayer Portal

- Fill VAT registration form

- Provide:

- Your PAN number

- Business details

- Estimated annual turnover

- Bank account information

Step 3: Submit Documents to IRD Office

Take these to your local tax office:

- Company registration certificate

- PAN certificate

- Business address proof (rent agreement or ownership document)

- Bank account details

- Identity proof of owner/directors

Step 4: Biometric Verification

- Visit IRD office in person

- They’ll take your fingerprints and photo

- Verification of documents

Step 5: Get VAT Certificate

- VAT certificate is issued within 3-5 working days

- Your VAT number will be the same as your PAN number

- Display the certificate at your business place

Total cost: FREE

Total time: 3-5 working days

Common Mistakes to Avoid

Mistake #1: Waiting Too Long

Wrong: “I’ll get PAN next year when I’m more established”

Right: Get PAN immediately when starting your business

Why it matters: Higher tax withholding rates (typically 15% higher) apply to those without PAN

Mistake #2: Not Tracking Your Turnover

Wrong: “I don’t know my exact sales, so I’ll skip VAT”

Right: Keep proper sales records from day one

Why it matters: If you cross the threshold and don’t register within 30 days, you’ll face penalties up to Rs. 10,000 per month of delay.

Mistake #3: Thinking VAT is Optional When Above Threshold

Wrong: “VAT is too complicated, I’ll skip it”

Right: If you’re above threshold, VAT is MANDATORY by law

Why it matters: Penalties for not registering can reach up to Rs. 20,000 per incident, plus you may be blacklisted

Mistake #4: Getting Only PAN for Import Business

Wrong: “I’m just importing for personal use”

Right: If you import goods worth over Rs. 10,000, you need both PAN and VAT

What Happens After Registration?

After Getting PAN:

- File yearly income tax returns (by mid-July every year)

- Use PAN for all official transactions

- Keep it safe you will need it forever

After Getting VAT:

- Charge 13% VAT on all your sales

- Issue proper VAT invoices with your VAT number

- File monthly VAT returns by the 25th of the following month

- Pay collected VAT to the government monthly

- Keep detailed records of all sales and purchases for 6 years

- Display VAT certificate at your business premises

Penalties for Not Registering

Let’s be clear: not registering when required is illegal and expensive.

PAN Penalties:

- Can’t open business bank accounts

- Can’t get business loans

- 15% higher tax withholding on transactions

- Can’t participate in government tenders

- Legal complications

VAT Penalties:

- Monetary fine up to NPR 10,000 for each month of delay

- Interest charges on unpaid VAT (15% per year)

- Business may be blacklisted

- Can’t claim input tax credits on purchases

- Legal action by tax authorities

Bottom line: The penalties cost way more than just registering properly. Don’t risk it!

Need Help?

Still confused about whether you need PAN, VAT or both? We get it tax stuff can be overwhelming!

At Karsansar, we help businesses with:

- PAN registration (same-day service)

- VAT registration (handled properly)

- Monthly VAT filing (so you never miss deadlines)

- Tax compliance (stay legal, avoid penalties)

- Free consultation (we’ll tell you exactly what you need)

I have both a job and a side business. Do I need two PANs?

One PAN is enough for all your income sources. But if your side business crosses the VAT threshold, you’ll need VAT registration.

How do I know my PAN/VAT application status?

Check the IRD website using your submission number, or contact your local tax office directly.